Identifying Performance Disparities

A large European Bank wanted to understand what was causing a performance gap between two branch locations. Despite similar customer segments and business structures, one branch consistently outperformed the other by over 300%. The bank deployed the Humanyze Elements Platform to understand what was causing the performance gap between branches. They measured corporate communication data like team communication patterns and physical activity within the office and segmented this data by compensation and tenure.

Office Layout Impacting Collaboration

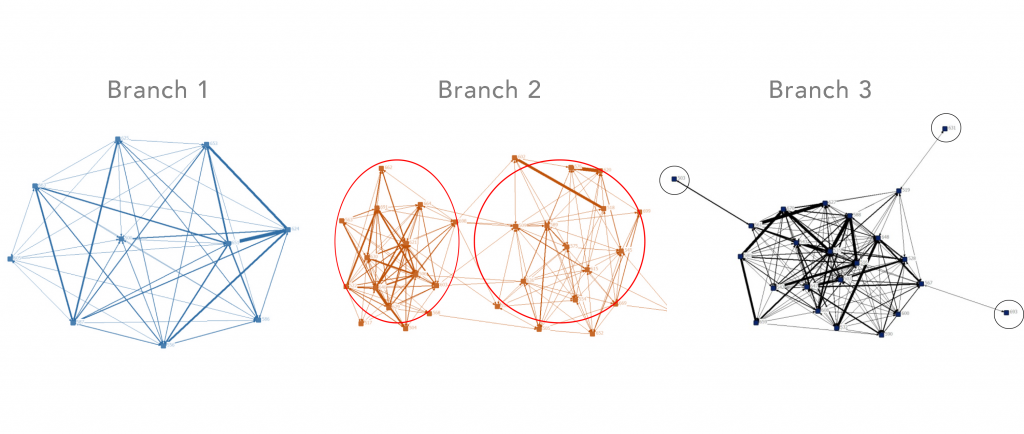

The Humanyze Elements Dashboard helped the European Bank uncover a pattern: employees at the strongest performing branches had significantly more face-to-face interactions throughout the day. Meanwhile, the lower performing offices had distinct subgroups and outliers. After analyzing communication patterns and work schedules, it was shown that the underperforming branches were being given less time to collaborate as a team and build trust. While employees at the high performing branches were consistently interacting with each other, increasing the potential for knowledge sharing and teamwork, the lower performing branches were missing out on these key conversations. Analysis of office layout data from both branches showed that poor office design was restricting communication patterns and limiting opportunities for collaboration throughout the day in the low performing branches.

Communication networks of three bank branches (Branch 1 has the highest performance, Branch 2 has the lowest performance, and Branch 3 has a high performing core with new employees that haven’t been socially integrated into the larger team)

Redesigning Office Space to Increase Sales by 11%

With this data, the bank was able to take several approaches to improving employee collaboration. First, the low performing branches redesigned their office space to increase employee interactions throughout the day, including restructuring and implementing a rotating desk system that allowed previously separated employees to interact with each other. Both low performing and high performing branches also implemented group bonus structures to encourage group performance and knowledge sharing and allocated funds for team building activities. As a result of the new initiatives, the under-performing branches saw sales increase by 11% to $1 billion over the next year.