Monitor your competitors’ hiring, sentiment, and leadership changes,

all in one place

Pulse surfaces hiring shifts, sentiment changes, and executive moves so you can act before competitors do.

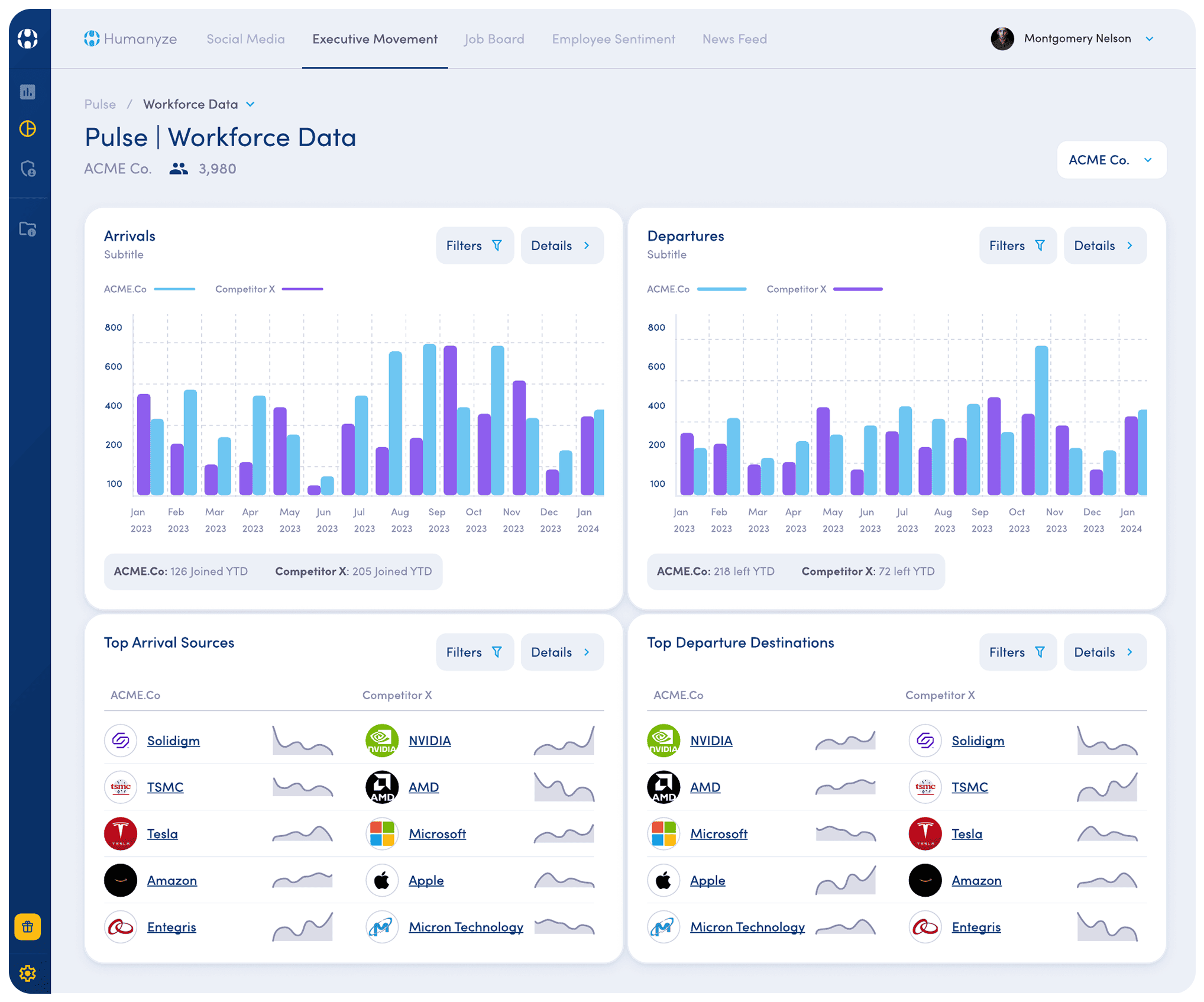

- See workforce departures and hiring patterns in real time

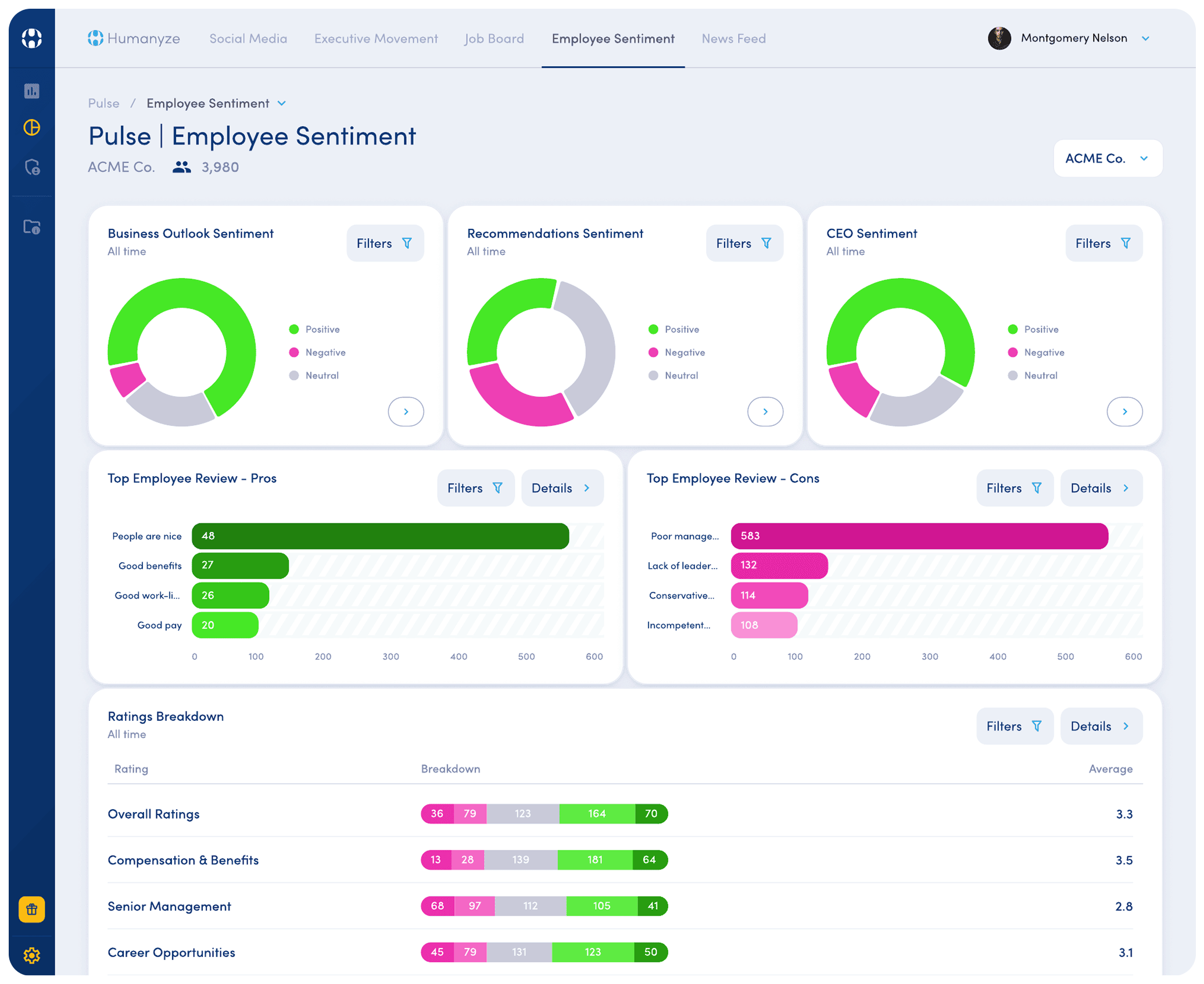

- Spot sentiment shifts before they impact attrition or brand

- Monitor competitors, market signals, and executive moves daily

Traditional reports leave you three steps behind

You’re already checking LinkedIn, news feeds and salary tools. But the signals are scattered and slow.

Pulse replaces the clutter with one real-time intelligence platform. It delivers the core value of multiple separate tools — all at a fraction of the cost.

No more missed hires, late pivots, or surprise questions in the boardroom.

Try Pulse Risk-Free

Pulse is AI-powered workforce intelligence that helps you benchmark leadership trust, employee voice, and talent signals in real time. If it’s not the right fit, cancel within 14 days for a full refund – no questions asked. For full details, please see our Refund Policy

AI-powered external market intelligence

You don’t need five tools to track the market. Pulse gives you real-time AI-powered intelligence from public data so you can spot shifts before they happen.

- Track workforce movements across your industry in real-time

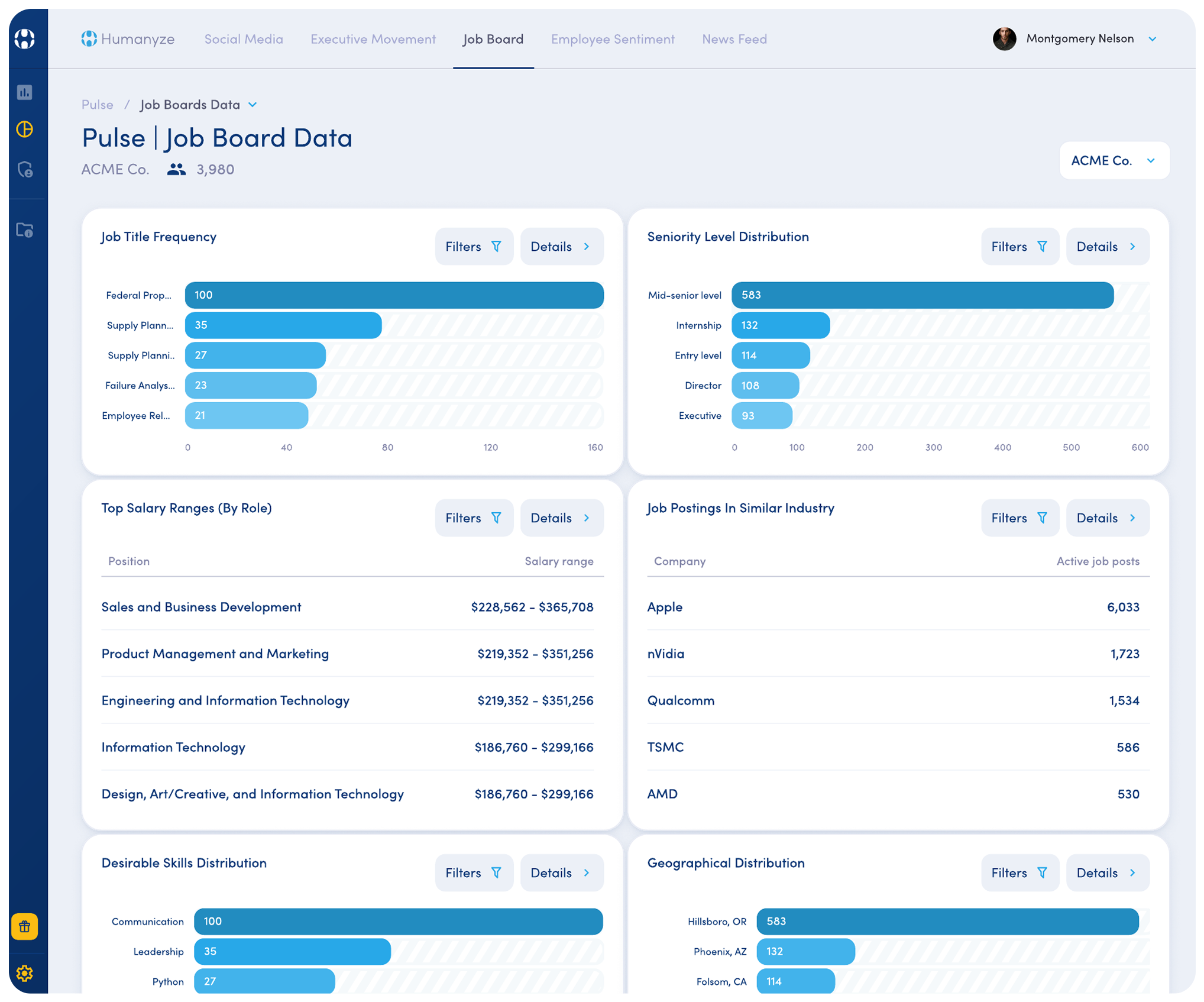

- Monitor competitor hiring, departures, and strategic signals daily

- Analyze employee sentiment and market perception instantly

Workforce and market shifts, automatically tracked for you

Pulse doesn’t just alert you to changes, it helps you understand why they’re happening and what to do next.

- Executive movement tracking with arrival and departure intelligence

- Competitor hiring patterns and salary benchmarking data

- Employee sentiment analysis across locations and departments

Spot executive churn, hiring slowdowns, and sentiment dips weeks before your competitors do

Pivot from reactive decision-making to proactive market leadership with intelligence that surfaces opportunities and threats weeks ahead of traditional research.

- Identify acquisition targets through workforce and sentiment analysis

- Predict talent retention risks before departures happen

- Spot competitor vulnerabilities through public sentiment tracking

Streamline Your Market Intelligence

All the signals you need, without the complexity of managing separate platforms.

The only intelligence that moves

faster than markets

Real-time markets need real-time intelligence

Every day without Pulse is a day your competitors see the market before you.

- Real-time workforce and market intelligence from public data sources

- AI-powered insights that predict trends before quarterly reports

- Competitive advantage through proactive external data analysis

Frequently asked questions

-

What makes Pulse different from traditional market research?

-

How quickly can we start getting intelligence from Pulse?

-

How current is the intelligence Pulse provides?

-

What data sources does Pulse aggregate?

-

Can Pulse track competitors of any size?

-

How does Pulse help with strategic decision-making?

-

What happens if I’m not satisfied with Pulse?